Blogs

- All

4 Mins Read | May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Introduction

The Reserve Bank of Australia (RBA) is set to announce its latest monetary policy decision on Tuesday, May 20, 2025 at 4:30 GMT. The upcoming meeting has drawn close attention across markets, with many expecting an RBA rate cut in response to soft inflation and global uncertainty.

Signals Pointing Toward a Shift

Market sentiment has gradually shifted over recent months. Inflation in Australia has been trending below the RBA's 2-3% target band, with March quarter CPI coming in softer than expected.. Combined with tepid household consumption and slowing employment growth, these indicators have contributed to a narrative that monetary easing may soon resume.

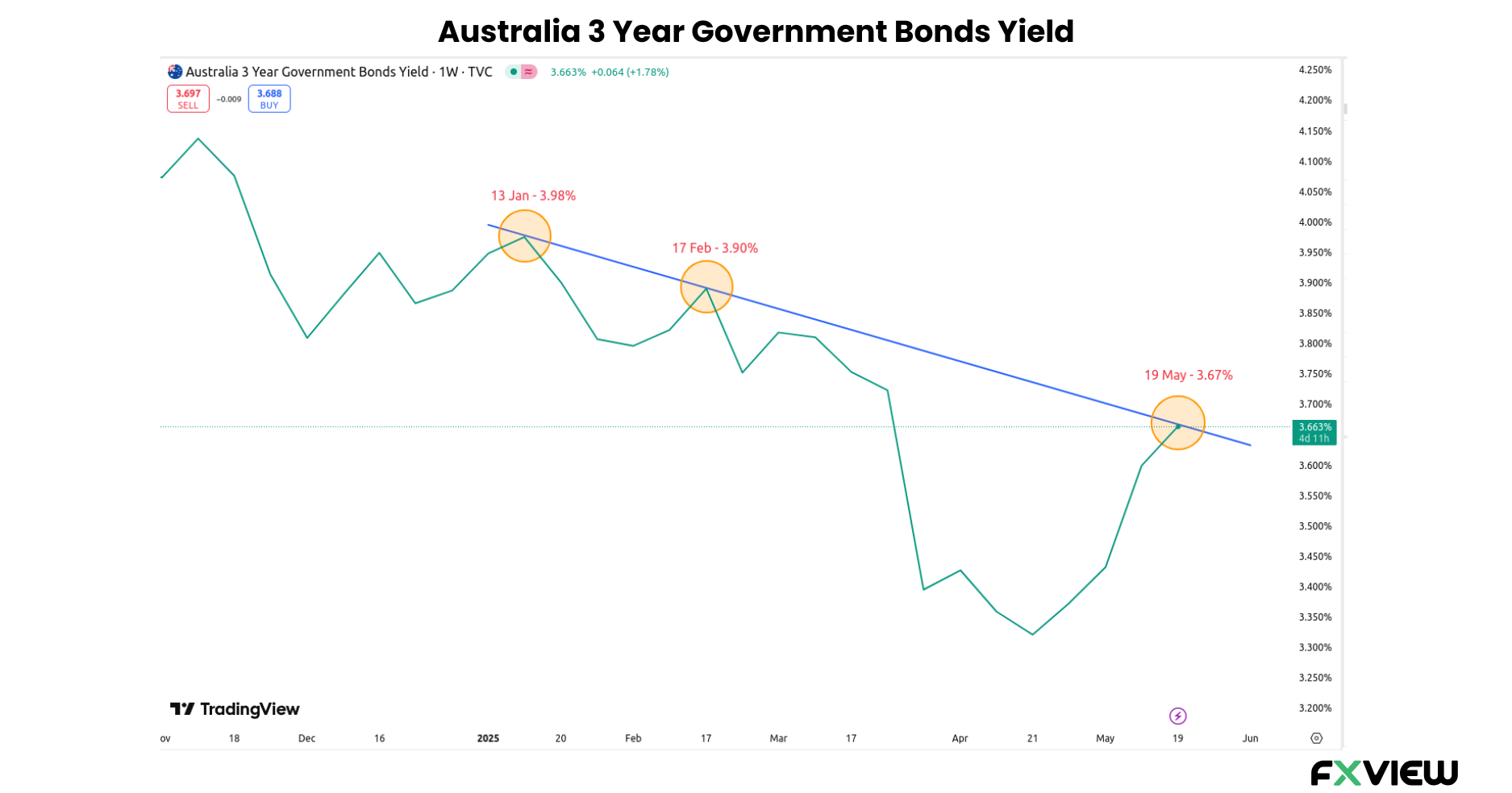

The bond market is already reacting. Yields on Australian 3-year government bonds have fallen by more than 31 basis points since mid-January 2025. The AUD has also weakened slightly against the USD, reflecting growing market confidence that RBA interest rate cuts are imminent.

AUD/USD has demonstrated notable resilience, buoyed by recent positive developments on the global front. A reduction in US-China tariffs, along with softer inflation readings in the US, has lifted investor sentiment. The upcoming RBA meeting and the potential implications for the Australian dollar are now firmly in the spotlight.

Reading the Market Mood on RBA Cuts

According to futures markets, there is a strong expectation that the RBA will reduce the cash rate by 25 basis points in its upcoming meeting. Some trading desks are even positioning for a total of three RBA interest rate cuts in 2025, with two more likely to follow in the second half of the year.

While this outlook aligns with recent global central bank pivots notably by the European Central Bank and Bank of Canada, some domestic institutions have cautioned against reading too far ahead. One major Australian bank leader recently poured cold water on the idea of a "supersized" rate cut, instead highlighting the importance of waiting for sustained evidence of economic slack.

The Economic Signals Behind the RBA’s Shift

The April Westpac IQ report outlines key macroeconomic conditions contributing to the RBA's evolving stance:

Inflation: Headline and core inflation are softening faster than anticipated.

Labour market: Job growth has moderated, and underemployment edging up to 4.1%.

Retail and consumer sentiment: Both metrics have dipped, indicating persistent household caution.

These internal signals, coupled with a slowing global economy and geopolitical uncertainty, seem to have increased the likelihood of a policy easing cycle.

Adding to the momentum, Wall Street gains following the US-China tariff rollback have also provided a supportive backdrop for Australian equities. Locally, the Australia 200 index has benefited from this global uplift, alongside a well-balanced April labour report. The domestic labour market appears steady, without exhibiting excess tightness that could complicate the RBA's decision-making.

Mortgage Trends Reflect Anticipation of Policy Easing

The Australian housing market is also reacting. Lenders and mortgage brokers are already seeing a shift in borrower behavior, as many homeowners and potential buyers anticipate lower interest payments ahead. Fixed-rate mortgage inquiries have reportedly increased, indicating a potential realignment in market strategy possibly influenced by upcoming RBA interest rate changes.

What Lies Ahead?

Traders will be closely monitoring:

- RBA’s tone on inflation and labor markets

- Any revision to economic growth forecasts

- Forward guidance on additional cuts in 2025

- Markets are not only pricing in the decision but also the language. A cautious tone with room for further easing could spur additional repositioning in FX and bond markets.

Conclusion

As the May 20 RBA decision nears, the confluence of soft inflation, declining bond yields, and shifting market expectations has led many to position for a 25 bps rate cut. While not guaranteed, the indicators suggest this is a credible possibility.

Advanced traders should remain alert to both the decision and the nuances of the accompanying policy statement. In a data-dependent environment, agility remains critical.

Looking to position around the RBA decision?

Explore competitive spreads and real-time analytics with Fxview. Access advanced trading tools to stay ahead of market shifts.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Oct 18th 2024

What is Algorithmic Trading: A Detailed Guide

Feb 12th 2025

What is Bollinger Band in forex- A Complete Guide

Feb 12th 2025

Support and Resistance Indicator- A Beginner's Guide

Feb 12th 2025

Carry Trade Explained: A Simple Strategy Guide

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

How to create a trading plan: A Comprehensive Guide!

Feb 12th 2025

Why is Reviewing Trading Plan Necessary?

Feb 13th 2025

AI Trading in 2025: A Breakthrough for Traders

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Feb 12th 2025

Understanding Diversification

Feb 12th 2025

Managing Risk while Trading Forex

Feb 12th 2025

Why do forex spreads widen? 6 critical reasons.

Feb 12th 2025

Technical Analysis in the Forex

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.