Blogs

- All

4 Mins Read | Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Introduction

Escalating geopolitical tensions between Israel and Iran have primarily driven the recent surge in oil prices. These rising tensions have raised significant concerns about potential disruptions to global oil supplies, particularly through the Strait of Hormuz, a key maritime chokepoint for oil transit. With oil benchmarks reaching multi-month highs, traders and energy executives are closely monitoring the situation, knowing that even minor changes in the region can lead to dramatic price movements.

Geopolitical Conflict and Its Impact on Oil Prices

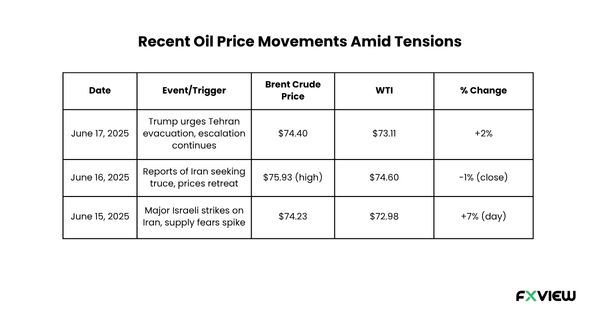

On June 16, 2025, Brent crude surged to $75.93 per barrel, marking a 7% increase—the largest single-day gain in recent months. West Texas Intermediate (WTI) also rose to $74.60 per barrel. The escalation was triggered by Israeli airstrikes on Iranian military and nuclear sites, including the South Pars gas field —a crucial source of Iran’s energy production. These actions heightened fears of broader regional instability and potential disruptions to global oil supplies.

This price rally was further intensified by the strategic importance of the Strait of Hormuz, through which around 20% of global oil supply transits daily. While the Strait remains open, Iran has previously threatened to close it in response to Western pressures, and such a disruption would likely trigger a global supply crisis, contributing to the sharp price fluctuations in the market.

Key Drivers of Oil Price Surge

- Israeli Airstrikes and Iranian Retaliation

The Israeli strikes on Iranian energy infrastructure, including the South Pars gas field, have significantly raised concerns about the vulnerabilities in Iran's energy infrastructure. In retaliation, Iran launched missile strikes on Israeli infrastructure, including an oil refinery in Haifa. This back-and-forth escalation has intensified fears of a broader regional conflict, which could disrupt oil production and further spike prices.

2. Strait of Hormuz: A Critical Chokepoint

The Strait of Hormuz plays a central role in global oil trade, with 18–20 million barrels of oil passing through daily. Any disruption of this critical passage, whether through military action or political maneuvering, would likely lead to a dramatic global supply shock. Although Iran has not yet closed the Strait, the potential risk of such an event continues to cause substantial price fluctuations in the market.

As reflected in the table, the volatility in oil prices has been largely driven by each new twist in the conflict. These fluctuations clearly indicate the market's sensitivity to geopolitical events in the region.

Oil Prices: Market Reactions and Expert Insights

The market's immediate response to the conflict has been significant, with traders adjusting their positions based on the latest developments. However, some experts caution that such geopolitical crises often result in temporary price increases, followed by stabilization once the immediate threat subsides. Historically, such price spikes during geopolitical crises tend to be short-lived unless the conflict escalates significantly.

Despite this, sustained high oil prices are predicted to exert upward inflation pressure, undermining consumer confidence and economic growth. Energy companies, such as Baker Hughes and Woodside Energy, have refrained from offering precise price forecasts, citing the unpredictable and rapidly changing situation in the region.

Short-Term vs. Long-Term Market Sentiment

Short-Term: Oil prices are expected to remain volatile. Any flare-ups in hostilities between Israel and Iran could lead to further price spikes, while news of de-escalation could temporarily ease the pressure on oil prices.

Long-Term: If tensions subside or diplomatic solutions bring about a truce, prices could stabilize or decline. However, prolonged instability or actions that disrupt key supply routes like the Strait of Hormuz could maintain higher prices for an extended period.

A Closer Look at Iran’s Role in Global Oil Markets

Iran accounts for about 3% of global oil production, with a significant portion of its exports directed toward China and Turkey. Any disruption to Iranian exports, particularly amid a broader regional conflict, could cause a dramatic spike in global oil prices. Traders are keenly aware that such disruptions could ripple across the global oil supply chain, impacting prices beyond the immediate region.Analysts & Experts Take on the Situation

Many market analysts have emphasized the unpredictable nature of the current geopolitical situation. While the immediate supply impact has been limited, the underlying risk premium has caused substantial price fluctuations. Experts continue to monitor the situation closely, noting that any further escalation could drive prices even higher.

Potential Outlook

The outlook for oil prices remains highly uncertain. If tensions de-escalate or diplomatic efforts lead to a truce, oil prices could stabilize or even fall, as the market reassesses the risk premium. However, should the conflict widen or Iran act on its threat to block the Strait of Hormuz, oil prices could surge even higher. Some analysts predict that in extreme scenarios, prices could approach $120 per barrel.

Conclusion

Oil prices have surged sharply amid rising tensions between Israel and Iran. While the market has shown resilience, volatility is likely to persist as the situation continues to unfold. Disruptions in the Strait of Hormuz and the broader Middle East region remain a significant concern for the global oil market. Traders must stay vigilant and adjust their strategies to accommodate sudden fluctuations in oil prices due to geopolitical shifts.

At Fxview, experience ultra-low spreads, lightning-fast execution, and access to multiple assets, allowing you to trade the news and capitalize on macro shifts in real time.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.