Blogs

- All

4 Mins Read | Feb 19th 2025

2025 Tariff Hidden Domino Effect on Oil, Gold & Inflation

The imposition of tariffs by Donald Trump in 2025 has sparked intense debates about their impact on inflation, gold, and oil prices. Understanding the hidden domino effect of tariff—leveraging their benefits while mitigating risks—is crucial for navigating this complex economic landscape. In today’s dynamic global economy, staying ahead of the curve is essential, whether you're trading gold, oil, or other assets.

Key Takeaways

- Oil prices have surged due to the 2025 U.S. tariff, driven by geopolitical risks and supply chain disruptions.

- Gold prices have soared as traders seek a safe haven amid inflation and global trade uncertainties.

- Tariffs contribute to inflation by raising the cost of imported goods and creating economic uncertainty.

- The Federal Reserve’s high interest rates add further complexity to the economic outlook.

- Long-term economic stability remains uncertain, posing potential risks to global prosperity.

What is a Tariff?

A tariff is a tax imposed by a government on imported goods. Its primary purpose is to protect domestic industries by making foreign products more expensive, thereby encouraging consumers to buy locally produced goods. However, tariffs can also serve as a tool for exerting political pressure on trading partners.

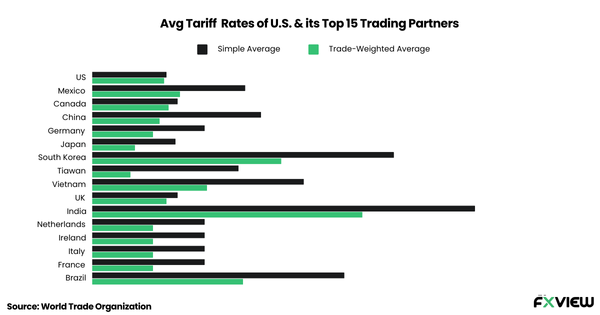

Historically, tariffs have significantly influenced global economies. For example, the Smoot-Hawley Tariff Act of 1930, which raised U.S. tariffs on over 20,000 imported goods, is often cited as a factor that worsened the Great Depression. In 2025, Trump announced plans to implement reciprocal tariffs on countries that impose duties on American imports, raising concerns about escalating global trade tensions.

Are Tariffs Good or Bad?

The effects of tariff are hotly debated among economists, policymakers, and traders. Here’s a breakdown of their pros and cons:

Potential Benefits

- Short-Term Trading Opportunities: Tariffs can create volatility in commodities like gold and oil, offering traders opportunities to capitalize on price swings.

- Protection for Domestic Industries: Tariffs can shield local industries, such as steel and aluminum, from foreign competition.

Potential Drawbacks

- Higher Consumer Costs: Tariffs increase the price of imported goods, leading to higher costs for consumers and businesses.

- Trade Wars: Tariffs risk triggering retaliatory measures, as seen in 2018 when China imposed $110 billion in tariffs on U.S. goods.

- Economic Uncertainty: Tariffs can disrupt long-term strategies by creating market instability. For example, U.S. steel and aluminum tariffs in 2025 have already driven up prices, raising concerns about inflation and economic stability.

The Domino Effect of Tariffs on Oil

Policy changes and geopolitical risks significantly impact the oil market. The 2025 tariffs have had a profound effect on oil prices, with ongoing repercussions for the global economy.

Rising Oil Prices

Following the introduction of tariffs, oil prices spiked due to concerns about supply disruptions. U.S. sanctions on Russia and Iran pushed Brent crude to $77 per barrel.

Historically, geopolitical events have caused oil price fluctuations. For instance, during the 1973 oil crisis, an OPEC embargo caused prices to double from $3 to $12 per barrel.

Supply Concerns

Supply chain issues were exacerbated by restrictions on Iranian oil exports and U.S. sanctions on Russian oil shipments to China and India. In 2022, Russia supplied about 10% of the world’s oil, and any disruption to this supply chain has significant global implications.

Market Volatility

The oil market remains volatile as traders adjust to the new reality of tariffs and their impact on global supply chains. While prices have risen in the short term, the long-term outlook is uncertain, with potential risks to inflation and economic growth.

The Impact of Tariffs on Gold

Gold has traditionally been a safe-haven asset during times of economic uncertainty. The 2025 tariffs have reinforced this trend, driving gold prices to record highs of $2,943.25 per ounce on February 11, 2025.

Safe-Haven Demand

As global trade tensions and inflation fears intensified, traders turned to gold as a hedge against economic volatility. Historically, gold performs well during economic downturns. For example, during the 2008 financial crisis, gold prices surged from $800 to nearly $1,900 per ounce by 2011.

Inflation Concerns

Tariffs have fueled inflation by increasing the cost of imported goods. Gold, often seen as a reliable store of value during inflationary periods, has seen heightened demand. During the 1970s, when U.S. inflation averaged 7.1%, gold prices rose from $35 to $850 per ounce.

Market Outlook

While the current economic climate has supported gold prices, rising interest rates and a stronger U.S. dollar pose challenges. However, as long as tariffs and geopolitical risks persist, gold is likely to remain a valuable asset for traders.

Tariffs and Inflation: A Dangerous Combination

One of the most significant concerns surrounding tariffs is their contribution to inflation. The 2025 tariffs have already driven up consumer costs, with the U.S. Consumer Price Index (CPI) rising at its fastest pace in over a year.

Rising Costs

Businesses reliant on imported goods, such as steel and aluminum, have faced higher costs due to tariffs. These increased expenses are often passed on to consumers, fueling inflation. For example, 2018 tariffs on washing machines led to a 12% price increase for consumers.

Economic Uncertainty

Tariffs create uncertainty, prompting businesses to delay investments or raise prices in anticipation of future costs. This behavior can further exacerbate inflationary trends.

The Fed’s Response

To combat inflation, the Federal Reserve has signaled its intention to maintain high interest rates. While this may help control inflation, it also raises borrowing costs and could stifle economic growth. Historically, the Fed has taken similar measures, such as in the early 1980s, when interest rates peaked at 20% to curb inflation.

Conclusion: The Road Ahead

The 2025 tariffs have triggered a domino effect on the global economy, impacting oil, gold, and inflation. While they present short-term trading opportunities, their long-term consequences remain uncertain.

As geopolitical risks and global trade tensions persist, traders must stay informed and adaptable. Understanding the hidden domino effect of tariffs leveraging their benefits while mitigating risks—is essential for navigating this complex environment. In today’s dynamic global economy, staying ahead of the curve is critical, whether you're trading gold, oil, or other assets.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. FXview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.