Blogs

- All

4 Mins Read | Apr 18th 2025

USD vs. Gold: Trump’s Tariff U-Turn and Where the Money Is Flowing

Introduction to USD and gold

In 2025, Financial markets are going through a dramatic change in 2025 due to new tariff policies announced by U.S. President Donald Trump. The trade war between China & U.S. has brought economic uncertainty.

Key Takeaways

- The U.S. dollar is under pressure, especially because of fears about inflation and trade problems.

- Gold hit an all-time high of $3,301 per ounce, and may go higher if trade tensions and inflation continue.

- Technical indicators like the Relative Strength Index (RSI) suggest high trading volatility, with gold showing bullish patterns and Indices showing bearish signals.

- If China & U.S. make peace, gold might decline and the USD could strengthen.

- Currency pairs that are affected by tariff policies are USD/CNY, USD/EUR, USD/CAD, USDJPY, GBPUSD, and USD/MXN.

- The economy could slow down, with reduced growth if tariffs stay for long.

USD vs. Gold: Tariff Impacts and Market Reaction

Tariff tensions in 2025 have indeed caused opposite movements of two major assets - gold & the USD. While gold boosted even higher as a safe-haven asset, USD has faced downward pressure due to growing uncertainty in the economy. This divergence grew stronger with the addition of new U.S. tariff measures in April.

On April 2, President Donald Trump declared the U.S. would impose a 10% tax on all imported goods starting April 5. A week later, on April 9, he indicated even higher tariffs would be imposed on countries importing a lot more to the U.S. than they export out of it. That same day, he did a partial U-turn on that plan by slightly reducing certain proposed tariffs while increasing tensions with China by imposing a massive 104% tariff, which was changed to 225% on April 17th.. It has helped fuel a great market rally for gold but injected more economic uncertainty.

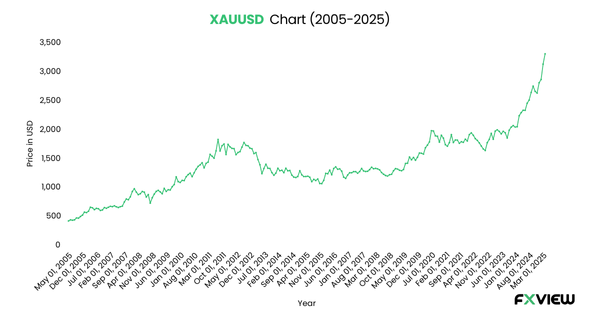

Gold Technical Outlook: Gold’s Historic Performance

In 2025, gold prices have skyrocketed due to trade war-related uncertainties. Its price reached an ATH at $3301/ounce with a year-over-year increase of more than 42%. This surpassed the earlier year-end forecast of Goldman Sachs from $3,300/ounce to $3,700/ounce.

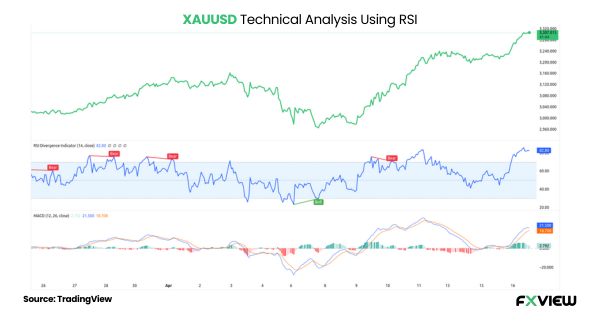

Technical indicators like RSI (Relative Strength Index) have shown a bearish divergence at times, but the market remains above MA, which indicates bullish potential for gold against the USD.

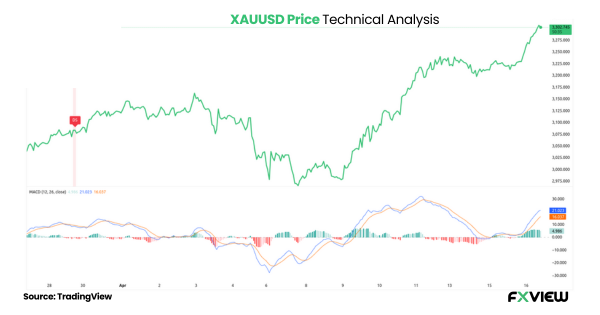

Gold: Chart Patterns, Support/Resistance & Market Mood

For gold, the chart data indicate a bullish trend with increased investor interest. The price chart currently does not display a significant resistance level, which reflects potential for the upward trend. In case of market correction, support is identified around the $2977 level. Trend lines show an ascending channel, and Doji patterns indicate a bullish trend, with MACD showing strength.

Gold's 2025 Outlook: Navigating Bullish and Bearish Scenarios

Gold prices could keep rising in 2025 if the ongoing U.S.-China trade war continues. These disputes could increase economic uncertainty and demand for gold as a safe-haven asset. Gold could push even higher, even above $3350, if tariffs continue to support inflationary prices, as investors can use it as an inflation hedge. This could weaken the USD as traders might trust gold more.

In case the trade war between the U.S. and China is resolved, it could slow down the inflation that affects gold demand as a safe haven. That could make the USD Stronger and gold prices lower.

Currency Pairs Affected by Tariff Policies

Trump’s tariffs have disrupted the forex market, especially concerning the following key USD currency pairs and the currencies of America's major trading partners.

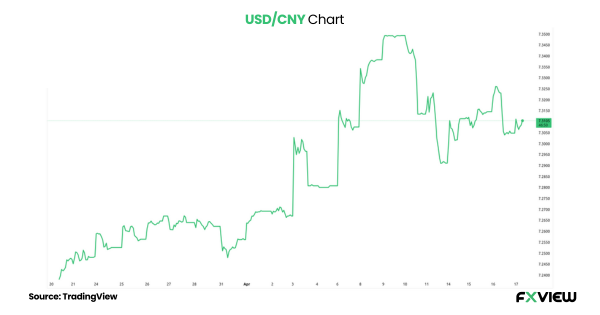

USD/CNY Pair: The USD/CNY pair is trading at 7.31, affected by the U.S. tariffs on Chinese exports which now go up at 245%. In retaliation, the People's Bank of China ordered state banks to restrain USD purchases to support the weakened Yuan. Heightened USD/CNY emphasizes the degraded trade position of China and strengthens gold's safe-haven appeal for investors.

EUR/USD Pair: The EUR/USD is currently trading at 1.13, slightly low but still near a four-week high as USD continues to feel downward pressure from tariff-related uncertainty.

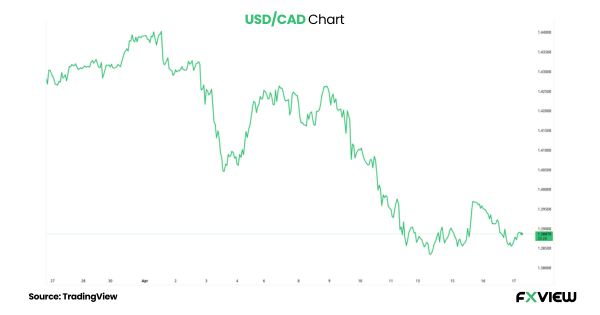

USD/CAD Pair: USD/CAD pair is at 1.39 after inflation numbers that drove Bank of Canada rate cut expectations. It fell back under 1.38 on April 17 due to some easing in concerns over Canada's export-driven economy during the current wave of tariff threats.

USD/MXN Pair: The USD/MXN pair is trading at 19.94, gaining 0.05% on the day as the economy of Mexico was being put under strain due to U.S. tariffs. Although the peso has gained 1.8% year-to-date, it is expected to weaken to 20.55 if trade tensions last.

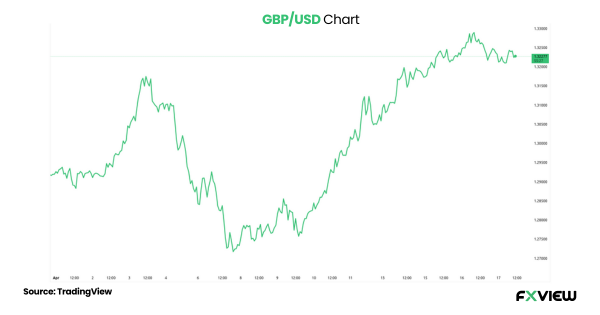

GBP/USD Pair: The GBP/USD trades at $1.32, holding steady for the eighth day in a row, supported by a weak dollar and hopes of a prospective US-UK trade agreement.

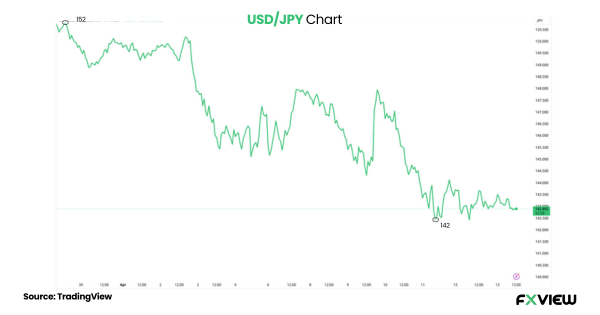

USD/JPY Pair: The USD/JPY chart shows a bearish move below 143, with support at 142 and resistance at 152. The dollar is still weak due to the recent threats of tariff imposition from the US and the uncertainty about US policy, which have shaken confidence in US economic stability.

Global Economic and Policy Implications

Tariffs could threaten the very possibility of starting a worldwide trade war, which could lead to the reduction of U.S. GDP by as much as 0.8%, with $2.2 trillion being generated as revenues in a decade, as suggested in the Tax Foundation Report. At the same time, consumer spending could probably decline, along with inflation. Thus, current currencies and commodities could be affected. Therefore, the central bank, including the Fed, can try to balance inflation and growth in the economy.

Conclusion

Ultimately, the tariff policies of Trump and their partial U-turn in 2025 continue creating a very volatile environment for not only the USD but also for gold prices. Gold is gaining on the back of safe-haven flows, while USD faces downward pressure from economic impacts and trading risks. Traders could focus on gold as a safe-haven asset and conduct their trading through technical analysis and risk management in times of volatility. Investors can, therefore, take these dynamics into account throughout their navigation of the financial markets, with tariff developments and technical levels as their primary indicators for decision-making.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.