Blogs

- All

4 Mins Read | Feb 14th 2025

2025 Crypto Bubble: A Volatile Rally Shaping Market Sentiment

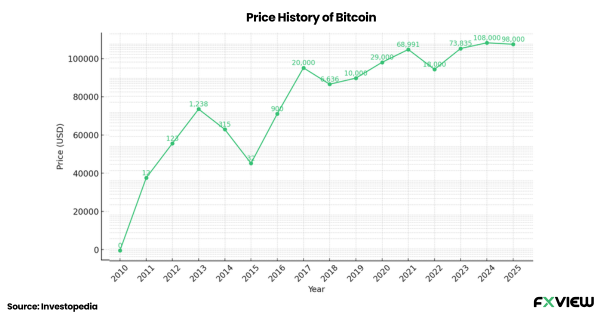

Since the beginning of 2025, the cryptocurrency market has experienced volatile swings, with Bitcoin leading the charge. Just days ago, Bitcoin surged past $100,000 to reach approximately $109,000. However, it has since retraced to around $98,000 fueling speculation about a major crypto bubble. Meanwhile, Ethereum is trading at $3,163.37, and Dogecoin at $0.34 both gaining momentum and driving bullish sentiment. Despite the excitement, the cryptocurrency market remains highly volatile, with regulatory changes and price fluctuations keeping traders on edge.

The trajectory of 2025 is critical for the future of the crypto market. However, it remains uncertain whether the current rally will sustain itself or lead to a potential bubble burst.

Key Takeaways

- Bitcoin's ups and downs: Despite Bitcoin's impressive 2024 performance, regulatory uncertainty and inflation concerns pose challenges for cryptocurrencies.

- Ethereum’s promising outlook: With its growing DeFi ecosystem and clearer regulations, Ethereum shows significant potential in 2025.

- Altcoin growth: The market is witnessing heightened volatility as altcoins like Litecoin (LTC), USD Coin (USDC), and XRP gain momentum.

- Regulatory changes: Positive regulations and increased interest from traders could stabilize cryptocurrencies and promote broader adoption.

- Market outlook: While there’s confidence in Bitcoin’s long-term potential, short-term fluctuations remain a key concern.

What Is a Crypto Bubble?

A crypto bubble occurs when the prices of cryptocurrencies rise far beyond their intrinsic value, often fueled by speculation and market hype. During these periods, traders and investors display extreme optimism about the market. However, as with any bubble, it risks bursting—leading to sharp and often prolonged price declines. Even when bubbles pop, they generate widespread excitement and have the power to reshape market sentiment.

2025: A Volatile Year for Crypto?

The cryptocurrency market in 2025 is shaping up to be a volatile year, with signs of a crypto bubble emerging across various market segments. The rise of Bitcoin and the strong performance of altcoins present both challenges and opportunities for traders.

Bitcoin’s Performance and Challenges

Bitcoin’s 2024 performance was remarkable, delivering a 121% return and reaching a peak of $108,135 before ending the year at $93,000. However, as we move through 2025, Bitcoin faces challenges that could influence its next moves.

Factors Impacting Bitcoin’s Price in 2025

- Interest Rates:

If the Federal Reserve lowers interest rates, market liquidity could increase, attracting more Bitcoin investments and boosting its value. Conversely, rising interest rates to combat inflation could decrease liquidity and drive prices down. - Inflation Trends:

Rising inflation may drive demand for Bitcoin as a “safe haven” asset. However, prolonged market uncertainty or sluggish global economic growth could dampen this growth. - Growing Adoption:

Increased adoption of Bitcoin by businesses and traders could support demand at key price levels, although cautious sentiment during uncertain times may offset this.

While external factors will largely determine Bitcoin’s future, analysts remain optimistic. They anticipate that robust demand at critical levels could signal a recovery, allowing Bitcoin to stabilize and potentially rally again.

Altcoins and Their Role in the Market

While Bitcoin continues to dominate the headlines, altcoins are making significant contributions to the ongoing volatile rally.

Ethereum’s 2025 Potential

Analysts predict that Ethereum may outperform Bitcoin in 2025. Key factors include clearer regulations, its expanding decentralized finance (DeFi) ecosystem, and the growth of Layer-2 networks. Following its post-merge decline, Ethereum has emerged as a popular choice for traders seeking opportunities.

USD Coin (USDC)

USDC, a stablecoin pegged to the US dollar, is becoming increasingly important for traders seeking stability amid market volatility. Its integration with DeFi systems simplifies transactions and liquidity provision, solidifying its role in the ecosystem.

Litecoin (LTC)

Litecoin’s faster block generation time and lower transaction fees make it an appealing choice for traders. Growing adoption has analysts projecting bullish trends, with prices expected to range between $550 in 2025 and $950 by 2029.

XRP

XRP has maintained its resilience, trading within a tight range of $2.32 to $2.49. Its unique dynamics and reliability have attracted traders, bolstering its strength in the market.

Crypto Bubble in the Altcoins Market

The rapid growth of altcoins has been a key feature of the volatile rally in early 2025. As Bitcoin rallies, many traders are shifting their attention to high-potential altcoins, driving their prices upward.

Bitcoin vs. Altcoins

Bitcoin’s price movements continue to influence the broader cryptocurrency market, including altcoins like Dogecoin. The strong positive correlation (0.68) between Bitcoin and Dogecoin suggests that the latter often mirrors Bitcoin’s performance.

As Bitcoin pulls back, altcoins like Ethereum and Dogecoin have shown resilience, reflecting the interconnected dynamics of the market. This correlation contributes to the formation of a crypto bubble, where prices of multiple cryptocurrencies rise simultaneously.

Market Sentiment: Bullish or Bearish?

The market appears divided in 2025. Concerns about inflation and geopolitical tensions create uncertainty, yet confidence has surged following Bitcoin’s rise above $100,000. While short-term price fluctuations are expected, analysts remain optimistic about Bitcoin’s long-term potential.

The Impact of Regulation on Market Sentiment

Regulation continues to play a pivotal role in shaping the cryptocurrency market. In 2025, cryptocurrencies are facing both opportunities and challenges due to regulatory changes, particularly in the US.

Positive Regulatory Developments

- A pro-crypto stance from President Trump’s administration, following the 2024 U.S. election, could stabilize the market.

- Paul Atkins’ appointment as SEC chairman may lead to relaxed regulations, fostering a more favorable trading environment.

- The approval of Bitcoin-Ethereum ETFs could simplify cryptocurrency investments for both institutional and retail traders, promoting market growth.

These changes may enhance market stability by reducing price volatility and encouraging broader adoption.

Conclusion

As 2025 unfolds, the cryptocurrency market’s trajectory will depend on price fluctuations, market sentiment, and regulatory developments. While Bitcoin remains the dominant force, the growing prominence of altcoins and the potential for favorable regulations suggest a promising albeit uncertain future for cryptocurrencies.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.