Blogs

- All

4 Mins Read | May 29th 2025

Silver Breakout: The Undervalued Commodity to Trade in 2025

Introduction

Commodities often perform best in uncertain times, and in 2025, silver is proving just that. While gold makes headlines with record highs, silver is quietly gaining momentum, drawing more interest from traders and long-term investors. With sharp year-to-date gains, deep industrial relevance, and a gold-silver ratio that strongly signals undervaluation, the metal is no longer a secondary consideration - it is emerging as a core asset in global commodity markets. Silver’s dual role - industrial metal and safe-haven asset - is increasingly relevant in today’s shifting global landscape.

In this blog, we explore what’s fueling the silver breakout, why 2025 may be a pivotal year, and how you can position yourself to benefit.

A Rally Gaining Momentum

Silver's 2025 performance has been impressive. As of May, it is trading between $32 and $33 per troy ounce, marking a 14-16% increase year-to-date. This surge has outperformed many other commodities, drawing comparisons to previous silver bull markets.

Despite still trading below its 2011 all-time high of $49.51/oz, the current rally is backed by stronger fundamentals than ever before. Market participants are increasingly seeing silver not just as a precious metal but as a strategic asset with industrial, monetary, and technological significance - all foundational pillars of this year’s silver breakout.

What’s Driving Silver’s Breakout in 2025?

Silver’s strength in 2025 is driven by a unique combination of structural factors that go far beyond short-term market sentiment.

Industrial Demand at Record Levels

Silver plays a critical role in the global transition toward clean energy and advanced technology. Its superior conductivity and chemical properties make it indispensable in:

- Solar panels now account for 12-15% of global silver demand. In 2025, China’s renewable capacity reached a record 1,500 GW, while Europe’s solar output rose by 30% year-on-year.

- Electric vehicles (EVs) and electronics, where silver is used in semiconductors, connectors, and batteries.

- AI and computing infrastructure, where the demand for reliable, high-efficiency components is growing rapidly. These industries continue to be a key driver behind the ongoing silver breakout.

Supply Constraints: A Market Under Pressure

At the same time, the silver supply is struggling to keep pace. For the fifth consecutive year, the silver market is facing a structural deficit. In 2024, the shortfall reached 200 million ounces, the highest on record. (Source)

The ongoing supply deficit is driven by a combination of structural challenges.

One major factor stagnant production in major mining countries like Mexico, Peru, and China. Regulatory hurdles, environmental restrictions, and rising operational costs have limited output growth, even as demand surges. In addition, few new mining projects are currently under development, suggesting that supply-side relief is unlikely in the near term.

This widening gap between supply and demand is putting persistent upward pressure on prices and could lead to tighter inventories as 2025 progresses.

Gold’s Rally: A Powerful Catalyst for Silver Breakout

Silver's current momentum is also being fueled by gold's record-breaking surge. Historically, silver tends to follow gold's lead, but with amplified returns. As gold approached $3,500/oz in 2024, analysts began highlighting silver’s potential to outperform during the next leg of the precious metals rally.

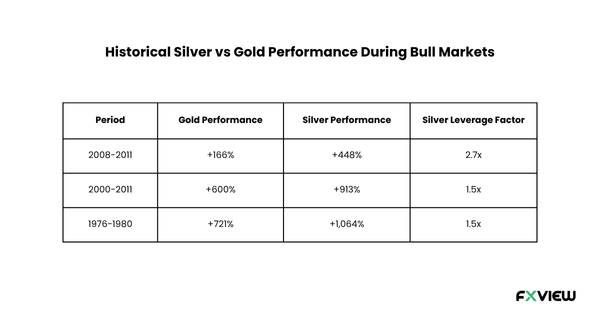

This is supported by historical data. During previous bull markets, silver vs gold performance has shown a clear pattern: silver not only followed gold but also dramatically outpaced it:

This "silver leverage factor" highlights a recurring trend: silver may lag early in a cycle but often delivers stronger percentage returns once momentum builds.

Statistical data supports this strong correlation coefficient of 0.89 between gold and silver prices since 2000, confirming a close link, yet still leaving room for silver to outperform during key periods.

Technical analysts also note that silver typically begins to surge 6-8 months after gold establishes a strong uptrend. With gold hitting all-time highs in 2024, this timeline aligns closely with projections of silver reaching $40/oz by mid-2025.

Silver’s Resurgence as a Monetary Asset

While gold often dominates discussions around monetary assets, silver is gaining renewed attention for its dual role as both an industrial commodity and a store of value. This resurgence is underscored by recent actions from major financial institutions.

In October 2024, Russia's central bank announced plans to diversify its reserves by including silver, marking a significant shift from traditional reserve compositions. This move aims to counteract sanctions and capitalize on silver's industrial and financial value.

This development suggests a broader re-evaluation of silver's role in national reserves, potentially signalling a trend where other central banks might follow suit. Such institutional interest not only reinforces silver's monetary appeal but also adds upward pressure on its demand and price.

Shifting Monetary Winds: A New Tailwind for Silver

Central bank policy is also playing a pivotal role in fueling silver’s breakout in 2025. With rate cuts expected throughout the year, the macroeconomic environment is becoming increasingly supportive for precious metals.

As interest rates decline, the opportunity cost of holding non-yielding assets like silver decreases. This dynamic makes silver more attractive compared to interest-bearing investments such as bonds or savings accounts, particularly in a climate of inflation uncertainty and currency volatility.

Silver’s resurgence as both an industrial and monetary asset places it in a unique position to benefit from this shift in policy sentiment.

What the Market Is Expecting

Financial institutions, analysts, and research houses have revised their price forecasts upward. The silver price forecast 2025 continues to gain momentum as more data supports bullish sentiment.

- Analysts expect silver to hit $38-$40/oz by the end of the year.

- Some long-range projections estimate $48-$50/oz, with a few bullish models forecasting $75/oz by 2027. (Source)

This surge in projections aligns with the broader market consensus that a long-overdue silver breakout is underway.

Key Catalysts Behind the Silver Breakout This Year

- Technical Breakouts: As of May 26, 2025, silver (XAG/USD) is trading around $33.50 per ounce, having recently tested resistance at $33.699. Technical indicators suggest a bullish trend, with potential targets at $34.166 and $34.948 if momentum builds. This could mark the next phase of the silver breakout rally.

- Fed Policy: The U.S. Federal Reserve has maintained its benchmark interest rate at 4.25%-4.50% as of May 2025. However, market expectations point toward potential rate cuts later in the year, possibly starting in September, depending on economic data and inflation trends.

- Global Liquidity: Investor interest in silver is evident, with physical silver ETFs up approximately 12% year-to-date and silver mining ETFs gaining around 25%. These inflows indicate a growing preference for tangible assets amid market uncertainties.

What Could Derail the Rally?

While the outlook for silver remains bullish, several headwinds could create short-term volatility. A meaningful correction in gold, potentially toward $2,800/oz, as some analysts suggest, could temporarily cool silver’s momentum, given the metals' historically tight correlation.

Meanwhile, continued strength in equity markets, like the Nasdaq’s 3.1% rise in April, signals investor preference for risk assets. If this risk-on sentiment persists, it may divert capital away from defensive plays like silver.

That said, these risks are seen as cyclical rather than structural. Most market watchers believe any pullbacks would offer buying opportunities, rather than signalling the end of the broader silver breakout trend.

Conclusion: Silver’s Time Has Come

Silver in 2025 is more than just a trade. It is a strategic play driven by real-world demand, constrained supply, monetary realignment, and macro uncertainty. The pieces are in place for a commodity that has long been overlooked to finally step into the spotlight.

Whether you're a conservative investor seeking protection or a tactical trader looking for momentum, the silver breakout represents one of the most compelling commodity stories of the decade.

To capitalize on silver’s breakout, you need a platform that offers ultra-tight spreads, fast execution, and the tools you need to trade confidently.

Trade Silver CFDs with Fxview and ride the breakout with confidence.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.