Blogs

- All

4 Mins Read | Jun 17th 2025

Upcoming Fed Interest Rate Decision: What to Expect on June 18, 2025

Introduction

This week, global financial markets are closely monitoring the upcoming Fed Interest Rate Decision from the U.S. Federal Reserve, scheduled for Wednesday, June 18 at 18:00 GMT. While policymakers are broadly expected to leave the federal funds rate unchanged at 4.25%-4.50%, attention is focused on the Fed’s updated economic projections and the communication accompanying this rate decision.

In a challenging economic environment with stubborn inflation, global tensions, and slowing growth, this meeting is expected to shape expectations for the rest of the year. Investors and policymakers worldwide will look to the Federal Reserve for direction on what comes next.

A Rate Hold Is Expected - but It's the Dot Plot That Matters

According to a Reuters poll of economists, the Federal Open Market Committee (FOMC) is expected to maintain the current policy rate. This would mark the sixth consecutive meeting without a rate change, reflecting the Fed’s cautious approach as it monitors evolving data on inflation and employment.

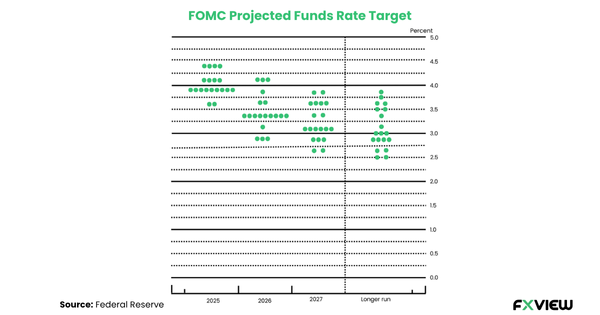

However, market participants are likely to focus on the Summary of Economic Projections (SEP) - particularly the dot plot, which outlines each policymaker’s expectations for interest rates over the coming years. As of the March meeting, the median projection indicated two cuts in 2025. Any adjustment to that outlook would significantly impact rate-sensitive assets and would be closely linked to the Fed Interest Rate Decision.

Commentary from Fed officials has recently reflected differing views on inflation risks. A U.S. economist cautioned that recent trade policy shifts, including tariffs and a rise in energy prices, could keep inflation elevated into 2026, potentially delaying rate cuts (Reuters).

Why the Fed May Hold Rates Steady

Several key factors may support the Federal Reserve’s decision to keep rates unchanged at the June 18 meeting, even as market participants hope for signs of easing.

- Inflation is moderating, but not fully anchored

While core inflation has eased from last year’s peaks, it remains above the Fed’s 2% target. Volatile oil prices - driven by Middle East tensions - and new tariffs may complicate the inflation outlook, prompting the Fed to remain cautious. - The Labor Market remains stable

With the unemployment rate hovering around 4.0%, the Fed is under less pressure to act immediately. A steady job market gives policymakers room to wait for further confirmation that inflation is sustainably declining. - Tariffs and fiscal risks add complexity

New trade measures introduced in early 2025 and widening fiscal deficits have introduced fresh uncertainty. Both could either slow growth or reignite inflation, making the timing of policy easing more delicate. - Political Pressure is mounting

President Donald Trump recently called on Chair Powell to "act fast and cut rates now." While the Fed remains independent, such commentary may increase scrutiny of its decisions, especially in an election year.

Market Positioning and Geopolitical Uncertainty: Pricing in Easing

Despite the Fed's cautious tone, markets are already positioning for a policy shift in the second half of 2025. The 10-year U.S. Treasury yield has declined to approximately 4.48%, and futures markets now reflect a high probability of a 25 basis point rate cut in September, with another potentially following before year-end, according to Investopedia. The backdrop for this shift includes not only decelerating inflation data but also renewed geopolitical risks, particularly the escalating Iran-Israel conflict. While not a direct factor in monetary policy decisions, the Iran-Israel conflict is introducing a new layer of uncertainty that the Federal Reserve cannot ignore. Crude oil prices have risen sharply. Brent is now trading near $78 per barrel due to broader Middle East tensions. This surge in energy costs, combined with potential supply chain disruptions and heightened investor risk aversion, complicates the Fed’s inflation outlook and increases volatility across global markets. These ripple effects may influence the Fed’s tone, especially if safe-haven flows push Treasury yields lower or if risk sentiment deteriorates further.

Meanwhile, the U.S. dollar has depreciated against a basket of currencies, reflecting expectations of lower interest rate differentials and concerns over trade-related disruptions. As reported by Reuters, currency markets have increasingly priced in a shift toward easing, in contrast to tighter stances from other central banks. Against this backdrop, the June Fed Interest Rate Decision becomes even more critical as policymakers weigh economic signals alongside mounting geopolitical pressures.

Global Implications: Monitoring Contagion Risks

The upcoming Fed Interest Rate Decision - and, more importantly, its forward guidance will have significant ripple effects across global financial markets.

In Europe, central banks are actively reassessing their policy paths. The European Central Bank (ECB) has recently signalled a potential shift toward easing. However, if the Federal Reserve remains on hold while others begin cutting, this could lead to interest rate divergence, potentially distorting capital flows, bond markets, and currency valuations across regions.

Across Asia and other major markets, investor sentiment is cautious. As highlighted by MarketWatch, U.S. stock indices have struggled to gain momentum, reflecting uncertainty around central bank direction and slower corporate earnings growth. Without clearer signals from the Fed, global equities may continue to trade in narrow ranges with limited conviction.

Policy Scenarios and Market Reaction

Analysts broadly agree that the Fed’s communication will likely fall into one of three broad categories, each with distinct market implications:

- Dovish Tilt: If policymakers revise their rate projections downward or Powell signals cuts are likely in the near term, risk assets could rally while bond yields and the U.S. dollar decline.

- Neutral Stance: If there are no material changes to guidance or projections, markets may remain range-bound while awaiting further economic data.

- Hawkish Hold: A firmer tone on inflation or external shocks, such as commodity price spikes or trade-related supply issues, could result in tighter financial conditions, a stronger dollar, and potential equity market weakness.

Trade the Fed with Confidence on Fxview

Whether you’re looking to position ahead of Powell’s press conference or react instantly to the Fed Interest Rate Decision, Fxview equips you with the tools to navigate Fed-driven volatility with confidence.

With ultra-low spreads, lightning-fast execution, and multi-asset access, you can trade the news or positioning around macro shifts in real time.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Oct 18th 2024

What is Algorithmic Trading: A Detailed Guide

Feb 12th 2025

What is Bollinger Band in forex- A Complete Guide

Feb 12th 2025

Support and Resistance Indicator- A Beginner's Guide

Feb 12th 2025

Carry Trade Explained: A Simple Strategy Guide

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

How to create a trading plan: A Comprehensive Guide!

Feb 12th 2025

Why is Reviewing Trading Plan Necessary?

Feb 13th 2025

AI Trading in 2025: A Breakthrough for Traders

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.