Blogs

- All

4 Mins Read | Feb 12th 2025

Why do forex spreads widen? 6 critical reasons.

A question that is guaranteed to pass every trader's mind is “Why Do Forex Spreads Widen?”. If you too are looking for an answer to this question, then you have arrived at the right place!

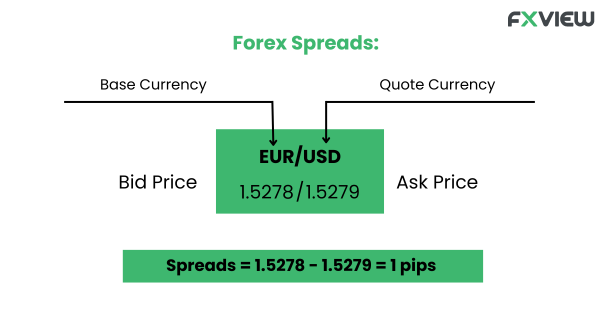

A Forex spread in the simplest terms is the difference between the ask and bid prices of a currency pair. Before we discover the many factors that influence the widening of Forex spreads, you can check out our blog “Spreads – Everything You Need to Know” to help you build your knowledge about this fundamental component of trading.

Now let’s dive into the many reasons why Forex Spreads widen!

Why Do Forex Spreads Widen?

1. Market Volatility: When there is a spike in market volatility due to economic or Geo-political events, it creates uncertainty in the market. This uncertainty decreases liquidity, as now traders grow more hesitant to trade. An effect of this growing uncertainty and reducing liquidity is widening Forex spreads.

2. Liquidity Providers: In the world of Forex trading, liquidity providers are crucial as they offer bid and ask prices for currency pairs. During times of low liquidity or high volatility, liquidity providers may withdraw from the market and widen spreads to mitigate their risk.

3. Time of Day: The level of activity and liquidity in the market can vary depending on the time of day. For example, the overlap between the European and U.S. trading sessions typically sees higher trading volume and tighter spreads, as market participants from both regions are actively trading.

Conversely, during quieter trading hours, such as the Asian session or late in the trading day, liquidity may thin out, leading to wider spreads. Traders should be mindful of these fluctuations in trading activity and adjust their strategies accordingly to minimise the impact of widened spreads.

4. Economic Events and News Releases: Economic events and news releases are other big factors that influence spreads. Economic indicators such as employment reports, GDP figures and central bank announcements might trigger sharp movements in currency prices and increase volatility.

You can access all global financial information at your fingertips through Fxview Economic Calendar and inculcate that information into your trade decisions to make better choices.

5. Illiquid Currency Pairs: Some currency pairs are inherently less liquid than others, meaning there are fewer buyers and sellers in the market. As a result, spreads for illiquid currency pairs tend to be wider compared to major currency pairs with higher trading volume and liquidity.

6. Changes in Market Sentiment: Shifts in market sentiment can influence trading activity and liquidity in the Forex market. If sentiment turns bearish or bullish suddenly, spreads may widen as traders rush to adjust their positions, leading to increased volatility and wider spreads.

Key Takeaways:

1. Forex spreads are fundamental components of the trading world that influence trading conditions.

2. There are several wide ranging factors that lead to the widening of Forex Spreads such as market volatility and sentiments.

3. Paying attention to these factors can help you anticipate these changes better.

Conclusion:

Developing your understanding about this fundamental trading component can help you boost your knowledge and confidence as a trader. The knowledge of why Forex spreads widen and how they can influence your trades gives you that extra push towards making well-informed decisions. Further elevate your trading experience and get access to tight spreads by starting a trade with Fxview!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.

Related Posts

View AllRelated Posts

Feb 12th 2025

Easy Forex Trading with Candlestick Patterns

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

Understanding the Long and Short Position in Trading

Feb 12th 2025

Trading the Volatility Index: A Comprehensive Guide

Feb 12th 2025

Participants in the Forex Market

Feb 12th 2025

Type of Charts in Forex

Feb 12th 2025

5 Common Mistakes in Forex Trading to learn from

Feb 12th 2025

Bear and Bull market in Forex

Feb 12th 2025

What is Forex Trading?

Feb 12th 2025

Discipline and Patience in Trading

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Feb 12th 2025

History of Forex Trading

Feb 12th 2025

Who are Liquidity Providers in Forex?

Feb 12th 2025

Spreads – Everything You Need To Know

Feb 12th 2025

Forex Market Sessions

Feb 12th 2025

Understand the Currency Pairs: Bid and Ask Rate

Feb 12th 2025

Forex Day Trading: A Beginner's Guide!

Feb 12th 2025

Forex Trading with Candlestick Patterns

Feb 12th 2025

Breakout in Trading- A Beginner's Guide!

Feb 12th 2025

Position Trading: A Beginner's Guide

Feb 12th 2025

Understand the Currency Pairs: Bid and Ask Rate

Feb 12th 2025

Types of Forex Orders: 6 Key Takeaways

Feb 12th 2025

Forex Rollover Rate for Smart Trading

Feb 12th 2025

Forex Market Sessions

Feb 12th 2025

Fibonacci Trading in Forex: A Beginner's Guide

Feb 12th 2025

What is a Contrarian Trading Strategy?

Feb 12th 2025

Understanding the Long and Short Position in Trading

Feb 12th 2025

Spreads- Everything You Need To Know

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

History of Forex Trading

Feb 12th 2025

What is Forex Trading?

Feb 12th 2025

Trading the Volatility Index: A Comprehensive Guide

Feb 12th 2025

Discipline and Patience in Trading

Feb 12th 2025

Understanding Diversification

Feb 12th 2025

Managing Risk while Trading Forex

Feb 12th 2025

Technical Analysis in the Forex

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.