Blogs

- All

4 Mins Read | Feb 12th 2025

A Beginner's Guide to the Forex Market Structure: It's Simpler Than You Think!

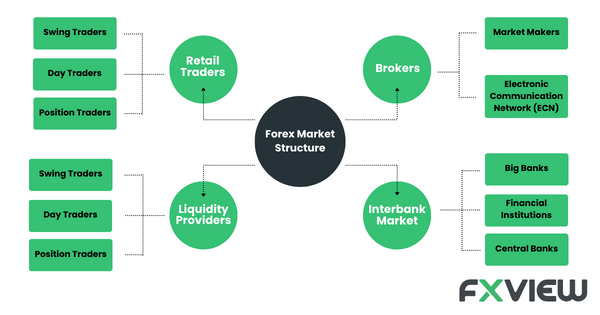

Let's take a closer look at the captivating Forex market structure, akin to a layered cake with each level having a crucial role in the market's performance. Grasping this hierarchy could be vital for anyone aiming to navigate the Forex landscape skillfully.

Retail Traders (The Foundation)

At the base of the Forex market structure pyramid, you'll find retail traders – everyday folks like us, shaking things up from our comfy spots! Retail traders are the life and soul of the market, they bring in excitement and contribute to its vibrant liquidity. They enter the scene through Forex brokers, who give them the tools and access to a variety of financial instruments. Retail traders have diverse backgrounds and have varying levels of experience. Some are day traders, executing multiple short-term trades in a single day. Others are swing traders, holding positions for days or weeks. There are also position traders who take long-term perspectives, holding positions for months or even years.

Brokers (The Connectors)

Just above the retail traders in the Forex market structure, we find the Forex brokers – the matchmakers connecting us to the vast Forex world. These types of brokers offer a plethora of services - top-notch trading conditions, trading platforms, insightful market analysis tools, and educational materials.

Now, did you know that brokers have a secret weapon? Leverage! It's like they're handing us a financial magnifying glass, allowing us to trade much larger positions than our own capital would normally permit. Pretty slick, isn't it? Just keep in mind though that using leverage can also expose you to higher risk while trading.

Brokers can be categorized into two types in the forex market structure: Market Maker and Electronic Communication Network (ECN) brokers. Market makers create a market for their clients by taking the opposite side of their trades, while ECN brokers aggregate liquidity from various sources, providing access to a more transparent and competitive market.

Liquidity Providers (The Market Lubricators)

Moving up in the Forex market structure, we meet the liquidity providers – the heavyweight market players. These are typically big banks and financial institutions, the backbone that keeps the Forex engine humming smoothly.

Their main gig? Creating liquidity. By tossing out quotes for various financial instruments, creating the prices that retail traders and brokers use for their trades. And with more providers available meaning more competition, which results in lower spreads for retail traders.

They also act as a kind of stabilizer in the market, soaking up big orders without making prices go all crazy. This keeps the Forex market nice and liquid, so traders can come and go whenever they please.

Interbank Market (The Pinnacle)

At the peak of the Forex market structure pyramid, we find the interbank market – the penthouse suite of Forex where big banks, financial institutions, and central banks engage in mega-currency dealings. Think of it as an arena of a financial battleground. Transactions here range from billions to gazillions, making retail trading look like pocket change.

Now, the central banks are the main players. They act as conductors, setting monetary policies, adjusting interest rates, and sometimes stepping in to stabilize their national currencies. When they take action, the financial world pays close attention and the markets react strongly!

Unveiling the Forex Market Structure: Key Takeaways

- Retail traders form the base of the Forex market structure. They trade currencies online using different strategies.

- Forex brokers act as middlemen, granting traders access to financial instruments, leverage, and trading platforms.

- Liquidity providers, often big financial institutions, make sure there are enough buyers and sellers, keeping the market liquid.

- At the top, the interbank market, with central banks and major institutions, greatly influences global currency exchange rates.

As we venture further into the world of Forex, we've peeled back its layers. At the bottom, you've got the everyday retail traders, and up at the peak, you've got the interbank market. They all pitch in to shape the Forex playground.

Remember that success in the Forex jungle requires not only a good understanding of this hierarchy but also the development of a sound trading strategy, risk management skills, and continuous learning.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.

Related Posts

View AllRelated Posts

Feb 12th 2025

Easy Forex Trading with Candlestick Patterns

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

Understanding the Long and Short Position in Trading

Feb 12th 2025

Trading the Volatility Index: A Comprehensive Guide

Feb 12th 2025

Participants in the Forex Market

Feb 12th 2025

Type of Charts in Forex

Feb 12th 2025

5 Common Mistakes in Forex Trading to learn from

Feb 12th 2025

Bear and Bull market in Forex

Feb 12th 2025

What is Forex Trading?

Feb 12th 2025

Discipline and Patience in Trading

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Feb 12th 2025

Why do forex spreads widen? 6 critical reasons.

Feb 12th 2025

History of Forex Trading

Feb 12th 2025

Who are Liquidity Providers in Forex?

Feb 12th 2025

Spreads – Everything You Need To Know

Feb 12th 2025

Forex Market Sessions

Feb 12th 2025

Understand the Currency Pairs: Bid and Ask Rate

Feb 12th 2025

Forex Day Trading: A Beginner's Guide!

Feb 12th 2025

Forex Trading with Candlestick Patterns

Feb 12th 2025

Breakout in Trading- A Beginner's Guide!

Feb 12th 2025

Position Trading: A Beginner's Guide

Feb 12th 2025

Understand the Currency Pairs: Bid and Ask Rate

Feb 12th 2025

Types of Forex Orders: 6 Key Takeaways

Feb 12th 2025

Forex Rollover Rate for Smart Trading

Feb 12th 2025

Forex Market Sessions

Feb 12th 2025

Fibonacci Trading in Forex: A Beginner's Guide

Feb 12th 2025

What is a Contrarian Trading Strategy?

Feb 12th 2025

Understanding the Long and Short Position in Trading

Feb 12th 2025

Spreads- Everything You Need To Know

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

History of Forex Trading

Feb 12th 2025

What is Forex Trading?

Feb 12th 2025

Trading the Volatility Index: A Comprehensive Guide

Feb 12th 2025

Discipline and Patience in Trading

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.