Blogs

- All

4 Mins Read | May 7th 2025

What the May’s Fed Interest Rate Decision Meeting Means for Traders

The Federal Reserve (Fed) is all set to announce its interest rate decision at 18:00 GMT today, followed by a press conference with Chair Jerome Powell at 18:30 GMT to discuss the committee’s decision.

The Fed’s Stance: Keeping It Steady Amid the Uncertainty

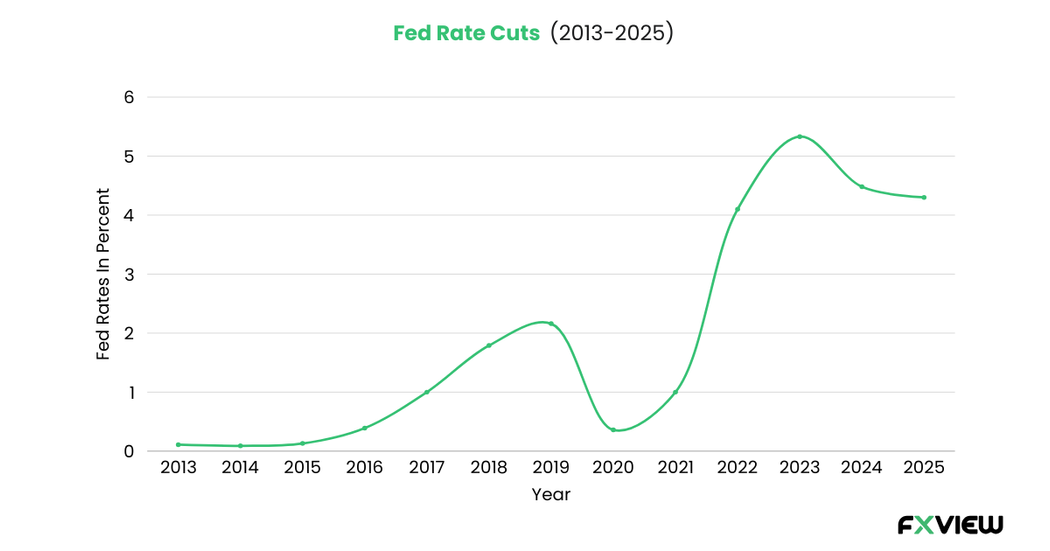

The Federal Reserve (Fed) is expected to keep its benchmark interest rate unchanged today, maintaining the federal funds rate in the 4.25%–4.50% range where it has remained since the most recent cut in December.

In March 2025, the Fed held rates steady at the same level, in line with Wall Street expectations. This cautious approach reflects concerns over President Donald Trump’s tariff policies, which have heightened the risk of stagflation, a potential scenario characterized by rising inflation coupled with slow economic growth.

Fed Chairman Jerome Powell has emphasized a data-driven approach, focusing on inflation and labor market trends, with potential rate cuts eyed for June or July if economic conditions weaken.

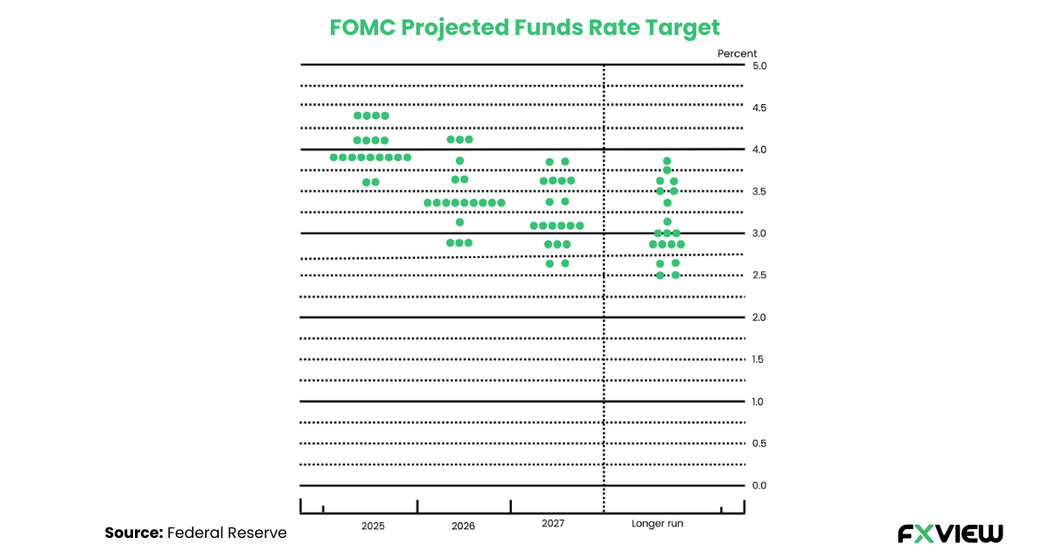

FOMC Projected Funds Rate

Each green dot, also known as the ‘dot plot,’ reflecting each member’s rate expectations = FOMC participant’s view of the federal funds rate midpoint for year-end or long run.

2025: Most officials expect rates in the range of ~3.75%–4.25%, reflecting a cautious outlook as inflationary pressures from tariffs and steady labor market conditions persist. This range suggests limited room for aggressive rate cuts in the near term.

2026: Projections shift lower to ~3.00%–3.75%, indicating expectations of easing monetary policy as inflation potentially moderates and economic growth stabilizes.

2027: Rates are expected to settle at 2.5%–3.5%, aligning with the Fed’s long-term neutral rate estimates, balancing growth and inflation in a post-tariff environment.

Why This Decision Matters to Traders

The Fed’s policy shapes asset prices across multiple markets. Here’s how the May decision could impact key instruments:

Forex: USD in the Spotlight

Interest rate decisions drive currency valuations. A rate hold could strengthen the U.S. dollar, attracting yield-seeking capital. Traders should watch pairs like EUR/USD, USD/JPY, GBP/USD, USD/CHF, and USD/CAD for volatility. A hawkish hold, signaling no near-term cuts, might depress EUR/USD, while dovish hints of future cuts could lift GBP/USD or USD/CAD.

Stocks and Indices: Growth vs. Inflation

The S&P 500 rose 1.1% after the March hold, reflecting equity resilience in a stable rate environment. However, tariff-induced inflation risks could pressure trader confidence. Broader equity markets may gain if rate cut expectations grow, while real estate and consumer discretionary stocks could weaken if Powell remains cautious. Sector-specific moves will hinge after Powell’s press conference.

Cryptocurrencies: Volatility Looms

Cryptocurrencies like Bitcoin and Ethereum respond sensitively to rate shifts. Lower rates often boost risk assets, but the current high-rate environment has fueled volatility. Post-March, Bitcoin dropped by 30% amid tariff fears. A dovish May signal could spark a rally, with speculative forecasts suggesting that Bitcoin could reach $250,000 by year end.

Commodities: Gold’s Safe-Haven Strength

Gold hit a record $3,500 after the March hold, driven by tariff uncertainty. A May hold could sustain this trend, especially if inflation persists. Oil remains range-bound ($70–$85/barrel), balancing supply constraints and growth concerns. Powell’s inflation comments could boost silver and platinum demand, but a stronger USD might cap gains. Commodities traders should stay vigilant post-announcement.

Key Factors Shaping the Fed’s Decision

Traders may track CPI, PPI, and jobs data closely. A weak jobs report could strengthen June cut expectations, impacting USD/JPY and S&P 500 futures.

The Fed’s May deliberations will consider:

- Tariff Pressures: Trump’s April 2025 tariffs on Chinese imports could push inflation above 2.7% (up from 2.5%), delaying cuts.

- Labor Market: April’s 177,000 job additions and 4.2% unemployment rate support a hold, but rising unemployment could shift policy.

- Inflation Trends: The PCE gauge showed 2.3% inflation in March, down from 2.6% but tariff-related pressures could reverse this progress.

- Fed Forecast Revisions: The Fed raised its 2025 inflation forecast to 2.7% with GDP growth projected at 1.7% and unemployment expected to reach 4.4%.

- Global Context: Potential rate cuts by the Bank of England and Bank of Japan in May could lead to market reactions.

Conclusion

While a May cut is unlikely, the FOMC statement and Powell’s press conference will hint at June’s meeting, where a 25-basis-point cut is possible if data weakens. The March dot plot signaled two 2025 cuts, making June’s update critical for long-term expectations.

Trading during Fed interest decision tests discipline. Tariffs and global trade tensions add complexity, but the Fed’s cautious stance mirrors a trader’s mindset: analyze data, avoid rash moves, and pivot when needed.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Oct 18th 2024

What is Algorithmic Trading: A Detailed Guide

Feb 12th 2025

What is Bollinger Band in forex- A Complete Guide

Feb 12th 2025

Support and Resistance Indicator- A Beginner's Guide

Feb 12th 2025

Carry Trade Explained: A Simple Strategy Guide

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

How to create a trading plan: A Comprehensive Guide!

Feb 12th 2025

Why is Reviewing Trading Plan Necessary?

Feb 13th 2025

AI Trading in 2025: A Breakthrough for Traders

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Feb 12th 2025

Understanding Diversification

Feb 12th 2025

Managing Risk while Trading Forex

Feb 12th 2025

Why do forex spreads widen? 6 critical reasons.

Feb 12th 2025

Technical Analysis in the Forex

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.