Blogs

- All

4 Mins Read | Mar 27th 2025

2025 Central Bank Policies and Their Profound Impact on Forex Traders

Key Takeaways

- Central banks are hugely influential in determining the value of currencies.

- The major institutions like the Fed, ECB, and BoJ move the financial markets through interest rates, QE, and interventions.

- Events like the one in 2008 or Black Wednesday illustrate the far-reaching aftermath of the actions taken by central banks.

- Federal Reserve policies affect forex instruments, notably those involving USD currency pairs.

- The Fed's decision to hold rates in January could create forex traders' considerations affecting the value of the currency.

- Hence, announcements in 2025 will be key to forex trading.

Understanding Central Banks in Forex

There are hundreds of other factors impacting the forex market but central bank policies may be the most important on any given day. For any forex trader, understanding the market impact of these institutions and how they operate can facilitate better decision-making.

How Central Banks Influence Forex Markets

Central banks have an important role in any financial system within a country. They manage monetary policies, oversee the control of the money supply, and maintain economic stability. Such decisions have a direct impact on the strength of currencies and their exchange rates, making these institutional authorities equally important to forex traders. Above all, these are central banks that shape the financial market by establishing their interest rates, managing inflation, and intervening in the currency markets.

Fundamentally, central banks aim to keep the stable economy. To achieve, they uses tools such as interest rate adjustments, open market operations, or even quantitative easing (QE). These policy adjustments create both trading opportunities and risks for forex traders.

Major Central Banks and Their Objectives

Regarding global influence, every central bank has its own peculiar aspirations and policies:

- The Federal Reserve (Fed): It focuses on maximum employment and price stability. Its interest rate decision impacts financial markets down to the value of USD value which is important for any forex trader.

- European Central Bank (ECB): Serving the Eurozone, keeping price stability as its top priority. Its policy changes can impact the Euro and pairs like EUR/USD.

- Bank of Japan (BoJ): It focuses on growth and uses negative interest rates to tackle deflation. It can also impact the Yen's behavior in the forex market.

- Bank of England (BoE): It focuses on tackling inflation and influences the British pound. It creates an opportunity for traders to monitor the GBP pairs.

How Central Bank Policies Impact Forex Traders and Markets

Central bank policies affect forex markets in numerous ways, creating both opportunities and risks for trading.

- Interest rate decisions: A currency often gets stronger with rising interest rates, as investors seek higher returns. A currency can also weaken due to a cut in rates. These changes can seriously affect forex traders if they fail to anticipate them correctly.

- Quantitative easing (QE): The increased money supply resulting from QE can devalue a currency. Such trends bring about generally higher trade volatility and shifting market trends, thus requiring traders to stay focused on signals from the central bank.

- Foreign currency intervention: Some central banks buy or sell their currency directly to maintain the value of their currency. This could surprise traders and also have immense economic impacts.

- Forward guidance: Most central banks give hints about their future policies. Getting ahead of their footsteps helps traders predict the changes that will follow in the current market movements.

These policies not only affect different currency pairs but also liquidity, trader sentiment, and overall market conditions. Forex traders have to monitor such changes to manage the changes more effectively.

Federal Reserve's Influence on USD Pairs

The USD plays a central role in forex markets, and the Federal Reserve’s policies significantly impact USD currency pairs:

- Interest Rate Hikes: When the Federal Reserve considers the increase of its interest rate, the obvious upshot is an appreciation of the US dollar against other currencies. This happens because higher interest rates attract new foreign capital, which in turn increases demand for the USD. According to the research, this benefits traders with long positions on USD by strengthening pairs like USD/JPY and USD/EUR.

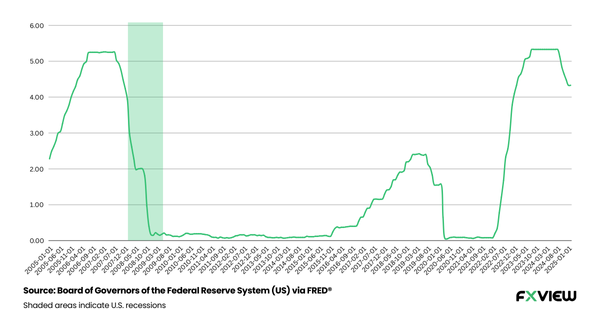

- Interest Rate Cuts: However, when the Fed cuts interest rates, the general impression about the USD remains rather bearish. Since there are lower interest rates, investors could find it much less appealing to hold assets denominated in USD currency, which in turn reduces demand for the currency. This was particularly evident during the time of the 2008 crisis, with the long positions in USD showing somewhat declining values.

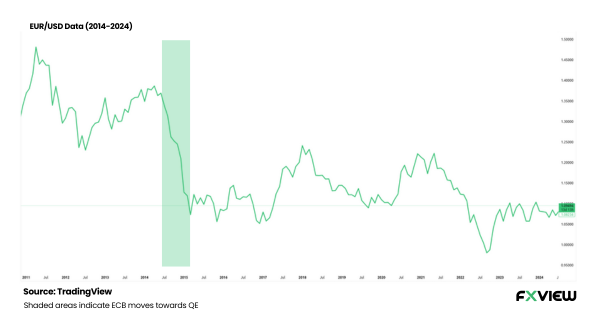

- Quantitative Easing: The Fed is importing government bonds in QE activities. The increase in the money supply usually weakens the dollar. Crises lead to dollars gaining temporarily in the short run, but longer-term depreciating value as QE continues. This trend affects pairs such as EUR/USD.

- Forward Guidance: The bad future policy direction statements made by the Fed are also capable of changing the price of the USD against market expectations. For example, hints toward the upcoming rate hike can contribute to increased volatility in pairs involving USD.

For decisions concerning the across-the-board market movements of the USD against other popular currencies, including USD/JPY, EUR/USD, and GBP/USD, traders must take note of the meeting dates and economic forecast along with policy announcements made by the Fed. The scheduled dates in 2025 for Fed meetings include January 29, March 19, May 7, July 30, September 17, November 5, and December 17.

Historic Market Trends After Central Bank Policies

These events demonstrate how important are the decisions made by central banks for not only short-run but also long-run impacts in terms of opportunities and risks in trading:

- 2008 Financial Crisis (Federal Reserve): Post-2008 financial crisis, the Fed announced QE and nearly went down to zero interest rate. However, the traders emphasized such impact by their moves about long-term changes in USD pairs. As long as the economy recovers, the USD gets weaker.

- 2015 ECB Quantitative Easing: The euro plunged when the ECB announced QE against other major currencies. This fact prompts many traders to look at movements in EUR/USD, due to high trading volatility.

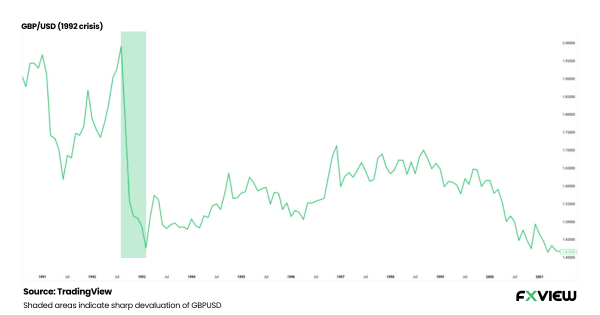

- 1992 Black Wednesday (Bank of England): BoE had withdrawn the pound from the European Exchange Rate Mechanism, causing an instant devaluation of the pound.

Central Bank Meetings in 2025 and Outcomes

Here are the outcomes of recent central bank meetings:

- Federal Reserve (March 18-19, 2025): The Federal Reserve meeting ended with the interest rates unchanged at 4.25%-4.50%, which indicates the steady pace of the economy and low unemployment rates. The decision is in line with its January meeting, with the dealers having to focus on the inflation data for future hints.

- European Central Bank (March 6, 2025): The ECB reduced its deposit rate from 3.00% in December 2024 to 2.75% in February 2025, and further down to 2.50% in March 2025, to get inflation under control and thus see economic stability. This may be seen as an action to weaken further the Euro against the dollar.

- Bank of England (March 20, 2025): The Bank of England has lowered rates from 4.75% to 4.5% in February 2025 due to inflation and economic scenarios, which increase volatility in GBP pairs. They maintain their rate at 4.5% in their March meeting.

- Bank of Japan (March 20-21, 2025): In January 2025, the bank increased rates for the first time in 17 years by 0.25% from that low level as a measure to fend off inflation and stimulate the economy and consequently yield a positive influence on the value of its currency, affecting its pairs. The two rates subsequently remained unchanged when they met from March 20 to 21, 2025.

What Could Be Expected Next in Central Bank Meetings?

The next meetings and potential outcomes are critical for forex traders to monitor:

- Federal Reserve (May 6-7, 2025): The next Federal Reserve meeting is on May 6-7, 2025. Given steady economic growth and low unemployment, the Fed could keep rates between 4.25% and 4.50%. Market players will keep a close eye on inflation data.

- European Central Bank (April 16-17, 2025): The next ECB meeting is set for April 16 and 17, 2025. Holding rates at 2.50% may be the case since inflation in February 2025 was at 2.3% but a rate cut would be on the table if data indicates the probability of more disinflation.

- Bank of England (May 8, 2025): The Bank of England's next meeting is scheduled for May 8, 2025. With UK inflation rising to 3.0% in January 2025, the BOE is expected to pause at 4.5%, keeping a guard all the way.

- Bank of Japan (April 30-April 1, 2025): The next BOJ meeting is scheduled for April 30 to May 01, 2025: inflation is at 3.7% in February 2025 with global uncertainty. Thus, there might be a pause at 0.5%.

Conclusion

Central bank policies-shifts in interest rates, quantitative easing, and forward guidance have significant effects on forex instruments, especially to which the dollar is tied. Such complex ambivalent events are best evidenced historically by a significant tail calling the 2008 financial crisis. Currencies, in the initial stages, appreciate only to later end up depreciating. Forex traders should remain alert and adapt to such dynamic transformation for successful forex trading in 2025.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Jun 19th 2025

Oil Price Movements Amid Israel-Iran Tensions

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.