Blogs

- All

4 Mins Read | Feb 12th 2025

What is Social Trading?

What if there was a tool that could assist you in tapping into a world of trading wisdom? Well you can, with social trading. Not sure what it entails? Then dive into this article as we discuss “what is social trading?” and much more!

What is Social Trading?

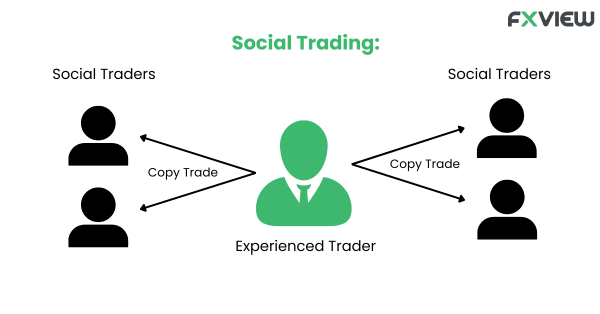

So, what is social trading? It is a form of investing that integrates social media-like features into online trading platforms. It enables traders to observe, follow, and replicate the trading strategies of other traders, often referred to as "trading gurus" or "signal providers." These signal providers share their trading activities, strategies, and insights on social trading platforms, allowing other users the opportunity to tap into their expertise.

What is Social Trading - How Does Social Trading Work?

The process of social trading typically involves the following steps:

- Selection of a Social Trading Platform: Investors choose a social trading platform that suits their preferences and investment goals. These platforms vary in terms of features, assets, and user interface.

- Finding Signal Providers: Users browse through profiles of signal providers available on the platform. They can analyse the performance history, risk metrics, and trading strategies of each provider to make an informed decision.

- Copying Trades: Once a user identifies a signal provider they trust, they can start copying their trades. This is usually done automatically through the platform's interface. When the signal provider opens or closes a position, the same action is replicated in the follower's account.

- Monitoring and Adjusting: Users can monitor their copied trades in real-time and make adjustments as needed. They can add or remove signal providers, adjust position sizes, or stop copying altogether.

What is Social Trading - Advantages:

- Access to Expertise: Social trading provides access to the strategies and insights of experienced traders, even for those who are new to trading.

- Diversification: Users can diversify their portfolios by copying trades from multiple signal providers who specialise in different markets or trading strategies.

- Transparency: Social trading platforms offer transparency by providing detailed performance metrics of signal providers, enabling users to make informed decisions.

- Learning Opportunities: Social trading could serve as an educational tool, allowing users to observe and learn from the trading activities and strategies of experienced traders.

What is Social Trading - Challenges and Risks:

Now that you know what is social trading, let’s uncover some challenges and risk associated with it:

- Over Reliance on Signal Providers: Relying solely on signal providers without understanding the underlying rationale behind their trades can be risky.

- Risk of Losses: While social trading can offer significant advantages, it also carries the risk of substantial losses, especially if users follow high-risk strategies or inexperienced signal providers.

- Market Volatility: Sudden market movements or unexpected events can lead to losses, regardless of the strategies employed by signal providers.

What is Social Trading - Types of Signal Providers:

- Experienced Traders: These are experienced traders who manually execute trades based on their analysis and market knowledge.

- Advantages: Human intuition and expertise can lead to flexible and adaptive trading strategies.

- Risks: Reliance on individual judgement can lead to emotional decisions and occasional mistakes.

2. Algorithmic Trading Systems: These signal providers use algorithms and computer programs to execute trades automatically based on predefined criteria.

- Advantages: Eliminate human emotions and biases, can handle large amounts of data quickly, and execute trades instantly.

- Risks: Performance may be affected by sudden market changes or glitches in the algorithm.

3. Hybrid Approaches: Combination of Manual and Automated Strategies: Some signal providers combine human expertise with automated trading systems.

- Advantages: Harness both human judgement and the speed and efficiency of automation.

- Risks: Still subject to human error in manual trading and technical issues in automated systems.

4. Social Trading Communities (crowd-sourced strategies): These signal providers leverage the collective intelligence of a community of traders.

- Advantages: Diverse range of perspectives and strategies, potentially more resilient to individual mistakes.

- Risks: Difficulty in evaluating the quality and reliability of information shared by community members.

5. Copy Trading Platforms (Mirror Trading): Platforms that aggregate trading signals from multiple sources and allow users to copy trades automatically.

- Advantages: Provides a wide selection of strategies and allows users to diversify their portfolios easily.

- Risks: Users may not fully understand the strategies being copied and could be exposed to unforeseen risks.

6. Social Influencers (Popular Traders): Well-known traders who have built a following due to their successful track record or social media presence.

- Advantages: Offer transparency and the opportunity to learn from skilful traders.

- Risks: Following blindly without understanding the trader's strategy can lead to losses.

Suggestions for Social Trading:

- Choose a Reliable Platform: Select a reputable social trading platform that offers a user-friendly interface, a wide range of assets, and robust security measures.

- Research Signal Providers: Before following or copying a trader, thoroughly research their trading history, performance metrics, and risk management strategies.

- Diversify Your Portfolio: Don't rely on a single signal provider. Diversify your portfolio by following multiple traders who specialise in different markets or use different strategies.

- Start with a Demo Account: Many social trading platforms offer demo accounts where you can practise trading without risking real money. Use this feature to familiarise yourself with the platform and test different strategies.

- Set Realistic Expectations: Understand that social trading doesn't guarantee profits. Make sure your expectations are based in reality and rationality.

- Monitor Your Investments: Regularly monitor the performance of your copied trades and adjust your portfolio as needed. Stay up-to-date about market trends and news as they could affect your trades.

- Stay Informed: Keep learning and stay updated on trading techniques, market analysis, and risk management strategies. Social trading communities and forums can be valuable sources of information and learning.

- Evaluate Continuously: Periodically review the performance of the signal providers you're following. If a trader's performance declines or their strategy changes, consider stopping or reducing your investment with them.

- Manage Risk: Use risk management tools provided by the platform, such as stop-loss orders, to limit potential losses. Avoid investing more than your risk appetite.

- Engage with the Community: Participate in discussions, ask questions, and share your experiences with other traders in the social trading community. Engaging with others can provide crucial insights and support.

Key Takeaways:

- What is social trading? It is a method where traders share and replicate trading strategies within a community platform.

- Social trading can be quite enlightening as it offers a learning opportunity while giving access to valuable trading experience.

- However there still remain certain risks in social trading such as over reliance and market volatility.

- There are various kinds of signal providers such as AI trading systems, experienced traders and trading communities.

Conclusion:

So now that you know what is social trading and how it works, you could use this understanding to delve into this world of community trading and learn from experienced traders as you build your knowledge of the trading world.

Disclaimer: The information in this article is provided for educational and informational purposes only and is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your research or seeking advice from an independent advisor.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is a Swap Rate? 5 Things You Need to Know

Feb 12th 2025

Understand CFD Trading: A Comprehensive Guide!

Feb 12th 2025

A Guide to Trade Commodity CFDs

Feb 12th 2025

Indices CFD trading

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.