Blogs

- All

4 Mins Read | Feb 12th 2025

Understand CFD Trading: A Comprehensive Guide!

Contract for Difference (CFD) trading has become an essential component of the financial world as it is a popular and accessible way for traders to engage in various markets without having ownership over the underlying asset. Whether you are an experienced trader or just starting out, it can be quite useful to understand CFD trading.

Treat this article as your guide to understand CFD trading and to explore what CFD trading means, how to trade CFDs, strategies for trading CFDs and ultimately why would someone give CFD trading a try!

Understand CFD Trading: What Does it Mean?

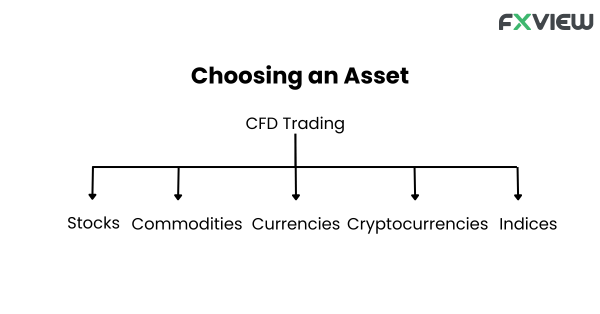

Let us understand CFD trading by taking music as an example. Just like you go to a music streaming platform to listen to your favourite tracks (without ever actually owning them), you can trade in CFDs by speculating on the price movements without ever owning the underlying asset. And just like your favourite songs, you may pick an asset of your liking from a range of options like stocks, indices, currencies and cryptocurrencies.

When trading CFDs you also get leverage which allows you to amplify your trading position with the help of your broker on an initial deposit. Allowing you to speculate price movements on leverage.

How to Trade CFDs

Now that you know what a CFD trade is, the next step in your journey of understanding CFD trading is to learn how to trade CFDs. Let’s have a look:

1. Choosing an Asset: In a CFD trade, you select one out of the many financial instruments (stocks, currencies, cryptocurrencies and indices) to enter a trade on. Allowing you the chance to pick your favourite asset to trade with or even explore new options.

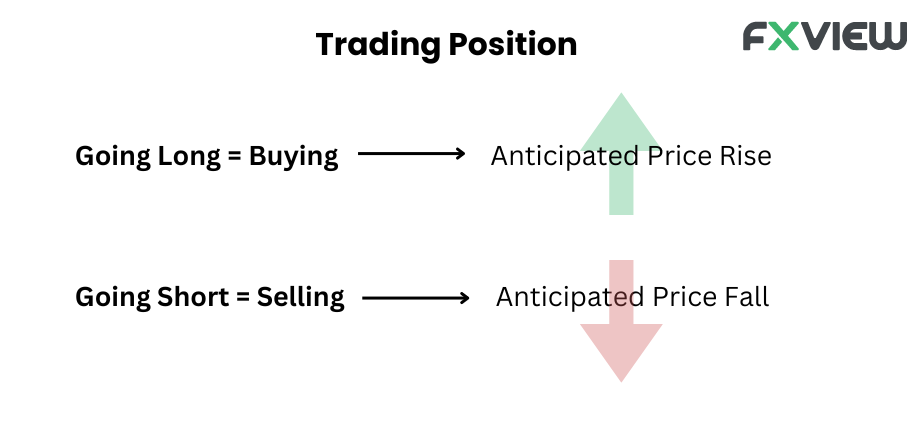

2. Long or Short Positions: Trading CFDs allows you to speculate price movements by going long (buying) if anticipating a price rise or short (selling) if anticipating a fall in price.

3. Opening a Position: When opening a position, you enter into a contract with your broker, specifying your trade size and your long or short position.

4. Monitoring and Closing the Position: Once a position has been opened (a CFD trade has been made), it is important to monitor the asset price movements. Based on which you can close your position at any time to either realise profits or cut losses.

Understanding CFD Trading - Strategies

1. Trend Following: You could use the trend following strategy to identify and follow the prevailing trend in the market to increase your chances of a potential profit.

2. Range Trading: This involves identifying a range in which the asset generally tends to trade within and opening a position based on that.

3. Breakout Trading: This strategy involves entering trades when the price breaks out of a significant support or resistance level, anticipating a continuation of the trend.

4. Hedging: This method involves using CFDs to hedge against potential losses in your investment portfolio. By taking offsetting positions and mitigating risk exposure.

Why Would Someone Try CFD Trading?

Now that you understand CFD trading, let’s look at some reasons that someone would give it a try:

1. Leverage: CFD trading allows you to leverage your positions, meaning you can control a larger position size with a smaller amount of capital. This amplifies both profits and losses, offering the possibility of potential for higher returns with a smaller initial investment, yet simultaneously heightening the risk of significant losses.

2. Diverse Assets: CFDs cover a wide range of financial instruments, including stocks, indices, currencies, commodities, and cryptocurrencies. This diversity provides you with trading opportunities across various markets and asset classes, allowing you to diversify your portfolios and capitalise on different market conditions.

3. Short-Selling: Unlike traditional investing, trading CFDs allows you to take advantage of falling prices by taking short positions. This means you can sell CFDs and buy them back at a lower price, capturing the price difference as profit. Although it's important to acknowledge that trading contracts for difference (CFDs) carries inherent risks, including the potential for losses if market conditions move against your position.

4. Flexible Trading Strategies: It accommodates various trading strategies, including day trading, swing trading, and position trading. You may take advantage of short-term price fluctuations or adopt long-term investment approaches, depending on your trading preferences and market conditions.

5. No Ownership of Underlying Asset: Trading CFDs enables you to speculate on the price movements of financial assets without owning the underlying assets yourself. This eliminates the need for physical ownership, storage, or delivery of the assets, making trading more accessible and convenient.

Suggestions for Trading CFDs

1. Choose a Reliable Broker: Select a reputable broker with competitive spreads, reliable execution, and robust trading platforms.

2. Stay Informed: Keep in-touch with market news, economic indicators, and geopolitical events that may impact the financial markets. You can use Fxview Economic Calendar to get global financial information at your fingertips.

3. Risk Management: Set strict risk management rules, including stop-loss orders to limit potential losses.

4. Start Small: You may begin with a demo account or trade with smaller positions to gain experience without risking substantial capital.

5. Continuous Learning: Stay curious and committed to learning about new trading strategies, market dynamics, and risk management techniques. Access our well-researched blogs to grow your trading knowledge!

Key Takeaways

1. CFD trading allows traders to speculate on price movements for various financial instruments without owning the underlying asset.

2. You can start trading CFDs in 4 straightforward steps: choosing an asset, choosing your position, opening a position and monitoring followed by closing the position.

3. Following a concrete trading strategy is primary when trading CFDs.

4. Start CFD trading and receive leverage, gain access to different financial assets and the ability to short sell.

5. Before starting CFD trading: choose a reliable broker, stay informed, learn continuously, manage risks and start small.

Conclusion

Now that you understand CFD trading better, you too could delve into the world of CFDs. Feel free to employ all the tips and strategies mentioned within this blog to improve your skills and enhance your trading experience by accessing all the resources Fxview has to offer. Don't forget to continuously educate yourself, stay disciplined and adapt to evolving market conditions to excel as a skillful CFD trader.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is a Swap Rate? 5 Things You Need to Know

Feb 12th 2025

What is Social Trading?

Feb 12th 2025

A Guide to Trade Commodity CFDs

Feb 12th 2025

Indices CFD trading

Feb 12th 2025

How to use the Butterfly pattern in Trading?

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

How to use the Bat Pattern in Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Feb 12th 2025

Forex Scalping Basics

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.